The contributions NHS staff make to their pensions is set to change this autumn. Lucy Brewitt explains how the new structure will affect payroll for workers at all levels.

There will be some major changes for staff who hold an NHS pension, starting in October, which will decide how much of their pay goes into their pension pot.

The government hopes these newly tiered staff pension contributions will feel fairer for everyone, regardless of their role.

These changes went out to consultation earlier this year, with 1,031 responses gathered from individuals, trade unions, employers, and other organisations. The consultation responses have varied in their overall sentiment, but the government says it believes it has struck the right balance and will move ahead with its proposals.

Pensionable pay will determine contributions

The change most favourably received by the sector (72%) was that actual pensionable pay would be used to calculate what contribution tier people belonged to. This is a departure from the use of notional whole-time equivalent (WTE) pay, which means that part-time workers must pay a contribution percentage as if they are working full-time.

In their response to this proposal, NHS employers said: “Using actual pensionable pay will specifically be fairer to members that work less than full time, and it is noted that this is more likely to apply to female members of staff. Employers have reported receiving queries from many part-time employees to ask why WTE is used to determine their contribution rate, when their benefits are based on actual earnings.”

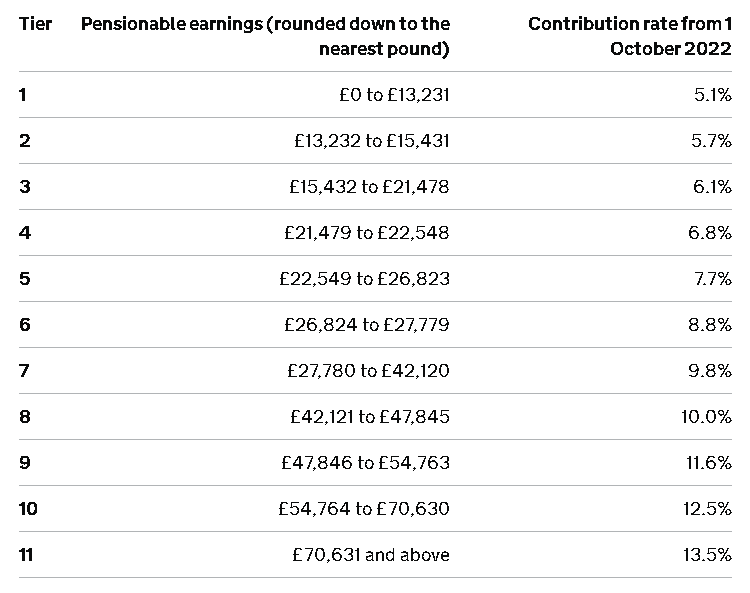

Changes to contribution tiers

An area of greater debate was the tiers which decide the percentage amount contributed.

The aim is to have employees put in, on average, 9.8% of their pay across the NHS. This number was decided by the government after it concluded, in the 2010 Spending Review, that this would strike a balance between contributions from NHS staff and the general taxpayer.

It was also thought an averaged-out 9.8% contribution, using tiers to decide how much an individual paid, would keep the pension scheme affordable for all staff; data from the NHS Business Services Authority shows about a third of members who opted out in 2019 to 2020 did so because of affordability.

How contribution tiers currently work:

The average contribution for members is 9.8% of their salary. However, this varies depending on how much you earn. At the time of writing, the lowest earners pay 5% and the highest (from £111,377) 14.5%. This is, the government says, a steeper transition from lowest to highest contribution tiers compared with other public sector pensions – and the highest “cross-subsidy” from high to low earners. In the Teachers’ Pension Scheme, for example, the range is 7.4% to 11.7% and the Civil Service Pension Scheme is 4.6% to 8.05%.

Keeping tiers, the government says, will ensure a wide range of staff, from porters to senior doctors, get to benefit from the pension scheme. We can safely say that the changes will stay in place for some time from October: the government has said that a “cautious pace” is appropriate for any further changes.

[Credit: UK Government]

The proposed contribution tiers themselves were not as well received by consultation respondents as the new method to determine which tier people belonged to. However, despite the objections it heard, the government has said it will go ahead with the new tiering system.

It says that thresholds will be a better fit for the current pay scales, as these tiers are set out more closely in line with Agenda for Change pay bands. Historically, small increases in pay can result in so-called “cliff edges”: sudden jumps up into a new contribution tier that would result in a decrease in take-home pay. Despite disagreement over the contribution tiers themselves, many consultation respondents still agreed that aligning it with Agenda for Change pay bands was a good thing, with 67% of respondents in favour.

A gradual change

The new contribution structure is set to be phased in by the government over about two years. The ambition is to create a robust tier contribution structure that will simultaneously minimise impact on take home pay and allow for time to adjust to any changes.

Furthermore, members who have transferred to the 2015 scheme from the one which went before will still have their final salary benefits calculated using their pay at retirement (or upon leaving the new system) – it is not calculated on the date that they leave the old scheme.

A complex system – a solution for you

NHS pensions are tricky to navigate, and as we can see, governments are not afraid to change things up. We manage NHS payroll, including pension arrangements, for staff across the UK every day, and we can give you advice or provide a full suite of solutions and services, so you can focus on staff and service users rather than keeping one eye on complex legislation.

To speak to one of our experts and find out about how we can help with your NHS pension scheme, please contact us.

Dataplan are one of the UK’s leading providers of specialist payroll and associated services.

From payroll outsourcing and pension service management to ePayslips and gender pay gap reporting; we have a solution for you and your business.