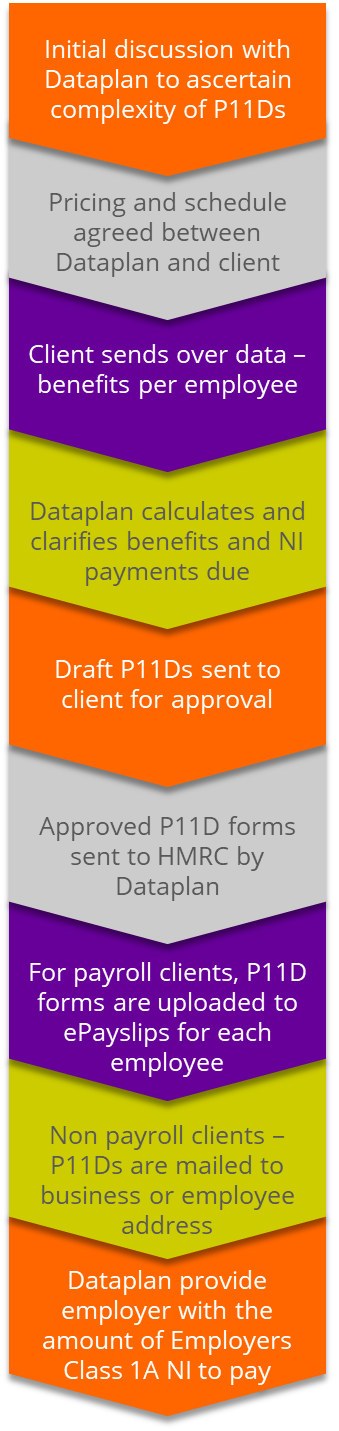

If you provide employees with benefits in kind, you must submit P11D forms to HMRC advising them of the benefits and pay employers Class 1A National Insurance Contributions.

This must be done by the 6th July following the end of the tax year.

For many organisations, this is an onerous task due to the risks associated with getting it wrong.

- Understanding which benefits in kind attract Class 1A National Insurance

- Ensuring the forms are completed correctly

- Gathering the information in a timely manner to meet the deadline

What are the risks?

There are hefty penalties for the late or incorrect submission of P11D forms;

- Non or overdue submissions - £100 per every 50 employees (or part 50) per month or part month

- You will also be charged penalties and interest if you are late paying HMRC

- Incorrect form penalties are based on a percentage of potential revenue lost according to tax payer behaviour and degree of culpability.

There is also a more significant risk than immediate penalties. For example, suppose P11Ds are submitted incorrectly for one employee. In that case, the chances are they will be wrong for all, as there has been a misunderstanding on how to classify and submit the benefits information. This could result in an employee either under or overpaying National Insurance. In addition, it would be a red flag to HMRC, triggering a full tax investigation, where they go through your records and processes with a fine tooth comb!